Soft Drinks Industry Levy: What impact has it had?

24 May 2021

What is the UK Soft Drinks Industry Levy?

The soft drinks industry levy (SDIL) is a tax on the level of sugar present in soft drinks, introduced as a measure which aimed to tackle childhood obesity in the UK by reducing the levels of sugar consumed in soft drinks.1,2 It is a two-tiered tax on manufacturers and importers of soft drinks in the UK.1 The SDIL aimed to tackle childhood obesity by encouraging soft drink producers to reformulate their products to reduce the sugar content.3 The levy also aimed to encourage importers to choose to import reformulated drinks lower in sugar.3 The SDIL was announced in March 20161 and was implemented in April 2018.

The SDIL includes the following taxes on sugary soft drinks:3

- Soft drinks which have more than or equal to 8g of sugar per 100mL are taxed at a rate of £0.24 per litre (high levy tier)

- Soft drinks which have between 5g and 8g of sugar per 100mL are taxed at a rate of £0.18 per litre (low levy tier)

- Soft drinks which with less than 5g of sugar per 100mL are not taxed

How effective has the SDIL been in reducing sugar consumption?

In March 2021, a new study was released by Pell et al,3* aiming to answer this very question. The study compared data from March 2019 to data from before the SDIL was introduced and aimed to determine whether there were significant changes in the volume purchased and sugar content of soft drinks as a result of the introduction of this legislation.3

Two previous studies have estimated there to have been as much as a 30% reduction in the sugar consumed through drinks included in the levy since it was introduced.4,5

This new study3 used controlled interrupted time series analysis to gain an insight into how the SDIL has affected purchase and consumption of sugar through soft drinks. The study found that the implementation of the SDIL was responsible for “changes in both the volume of, and sugar purchased in, drinks in many categories”.3

When all soft drinks were combined (including those with <5g sugar and therefore exempt from the levy) total volume purchased was not reduced by the SDIL.3 However, across all soft drinks categories combined, sugar decreased by 9.8% (29.5g) per person per household.3 Certain categories, including high tier and low tier soft drinks, experienced significant reductions in volume purchased and sugar content as a result of the SDIL.3

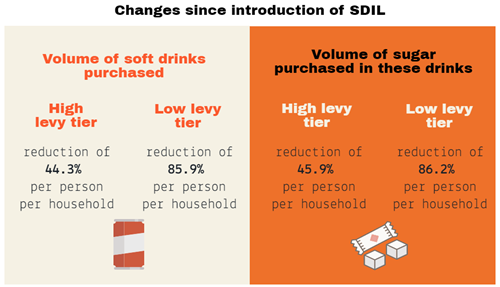

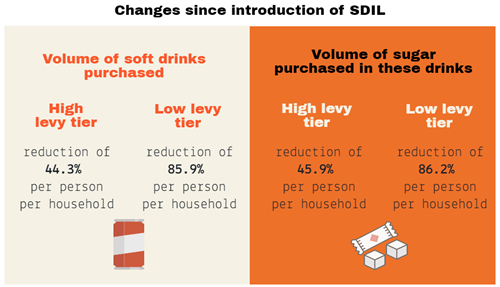

Findings of the study included:

- The volume of high tier soft drinks purchased decreased

The implementation of the SDIL was associated with an estimated 44.3% reduction in the volume of high tier drinks purchased (155 mL reduction in purchase per household per week).3 - The volume of sugar purchased in these high tier soft drinks decreased

The implementation of the SDIL was associated with an estimated 45.9% reduction in the volume of sugar purchased within these drinks (the volume of sugar purchased in these drinks decreased by 18g per household per week).3 - The volume of low tier soft drinks purchased decreased

The implementation of the SDIL was associated with an 85.9% estimated reduction in the volume of low tier drinks purchase (177.3 mL reduction in purchase per household per week).3 - The volume of sugar purchased in low tier soft drinks decreased

The implementation of the SDIL was associated with an estimated 86.2% reduction in the volume of sugar purchased within these drinks (the volume of sugar purchased in these drinks decreased by 12.5g per household per week).3 - Sugar in unlevied drinks increased

Concerningly, the average amount of sugar purchased in drinks which are not included in the levy (those with under 5g of sugar) increased since the implementation of the SDIL.3

Based on data from Pell et al. (2021)

Conclusions and next steps

It is concerning that the volume of sugar purchased in unlevied drinks increased as a result of the introduction of the SDIL - this is thought to be due to producers altering sugar content to be just below the levy threshold.3 This could potentially be remedied by lowering the threshold of sugar concentration at which soft drinks are included in the SDIL (lowering it below the 5g mark).3,6 The total volume of sugar purchased through soft drinks could also potentially be further decreased by expanding the drinks included in the SDIL, such as to milk-based drinks and other high sugar categories currently exempt from the levy.3,6

Overall, the data presented above indicates that, as a result of the introduction of the SDIL, not only are producers reformulating products to be lower in sugar, but consumers are also purchasing lower sugar alternatives. The fact that overall sales of soft drinks were unchanged, but that levied drinks were significantly reduced in both volumes purchased and sugar content highlights that this legislation could have a significant effect on public health, without detriment to industry.6 This evidence should support the introduction of further regulatory legislation to promote a healthy diet in the UK and Scotland.

*Since the publication of this blog, the size effects found in the Pell et al. 2021 have been corrected. The household sugar reduction was found to be 3% instead of the 9.8% originally reported. The full corrected paper can be found here.

- The UK Government (2016) Soft Drinks Industry Levy - GOV.UK. https://www.gov.uk/government/publications/soft-drinks-industry-levy/soft-drinks-industry-levy#general-description-of-the-measure. Accessed 25 Mar 2021

- The UK Government (2018) Soft Drinks Industry Levy comes into effect - GOV.UK. https://www.gov.uk/government/news/soft-drinks-industry-levy-comes-into-effect. Accessed 25 Mar 2021

- Pell D, Mytton O, Penney TL, et al (2021) Changes in soft drinks purchased by British households associated with the UK soft drinks industry levy: Controlled interrupted time series analysis. BMJ 372:. https://doi.org/10.1136/bmj.n254

- The UK Government (2019) Sugar reduction: progress between 2015 and 2018 - GOV.UK

- Bandy LK, Scarborough P, Harrington RA, et al (2020) Reductions in sugar sales from soft drinks in the UK from 2015 to 2018. BMC Med 18:. https://doi.org/10.1186/s12916-019-1477-4

- Jones A, Wu JHY, Buse K (2021) UK’s sugar tax hits the sweet spot. BMJ Publishing Group