Chile's Sugar Tax

Prior to 2014, Chile had a 13% ad-valorem tax on non-alcoholic drinks. However, with the passing of Law No. 825 in 2014, a tax increment was introduced specifically targeting sugar-sweetened beverages (SSBs). Beverages containing 6.25 grams or more of sugar per 100 millilitres had an increase in tax rate from 13% to 18%. Simultaneously, beverages with low or no sugar content had their tax rate reduced from 13% to 10% [1]. It's important to note that the tax is applicable to all SSBs, regardless of whether they are domestically produced or imported.

The reforming of Law No. 825 was the culmination of a multi-year campaign led by public health advocates and academics. Their argument centred around the notion that the high consumption of SSBs in Chile was a major contributor to the country's obesity epidemic [2]. The law received support from the Chilean government as a means to decrease SSB consumption and enhance public health outcomes.

Implications

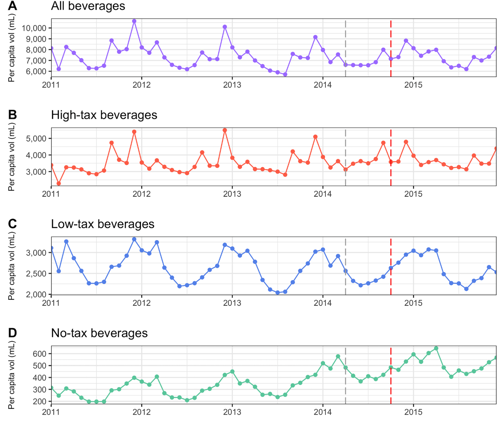

The sugar tax in Chile has demonstrated several positive outcomes. In the first year following its implementation, there was a substantial 22% decrease in the monthly volume of heavily taxed sugary drinks purchased. Both the middle and high socioeconomic groups experienced declines of 16% and 31% in their monthly purchase volumes, respectively. Similarly, the low socioeconomic group observed a 12% reduction in their purchase volume [2]. This decline can be attributed to a decrease in the quantity of SSBs being purchased as well as a shift towards lower-sugar alternatives.

The sugar tax implemented in Chile has been a successful public health intervention, leading to a significant decrease in the consumption of heavily taxed sugary beverages. This reduction was observed across different socioeconomic groups, with a shift towards lower-sugar alternatives. The tax has effectively contributed to a decrease in overall added sugar intake. The success of the sugar tax in Chile serves as an important example for other countries seeking to combat excessive sugar consumption and improve public health.

References

[1] Cristóbal Cuadrado, et al. (2020) Effects of a sugar-sweetened beverage tax on prices and affordability of soft drinks in Chile: A time series analysis. Social Science & Medicine, Volume 245, ISSN 0277-9536 https://doi.org/10.1016/j.socscimed.2019.112708

[2] Nakamura, R., Mirelman, A. J., Cuadrado, C., Silva-Illanes, N., Dunstan, W., & Suhrcke, M. (2018) Evaluating the 2014 sugar-sweetened beverage tax in Chile: An observational study in urban areas. PLOS Medicine, 15(7), https://doi.org/10.1371/journal.pmed.1002596

Chile's Food Labelling Law

Chile's Food Labelling Law

How Chile regulates food advertising

How Chile regulates food advertising